38 bond coupon interest rate

Coupon Definition - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value, both of... Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond coupon interest rate

How to Calculate the Price of Coupon Bond? - WallStreetMojo Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. Therefore, the price of each bond can be calculated using the below formula as, Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers. Individual - Series I Savings Bonds - TreasuryDirect I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year ; Interest-earning ...

Bond coupon interest rate. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Individual - Treasury Bonds: Rates & Terms The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) The price of a fixed rate security depends on its yield to maturity and the interest rate. Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's... Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

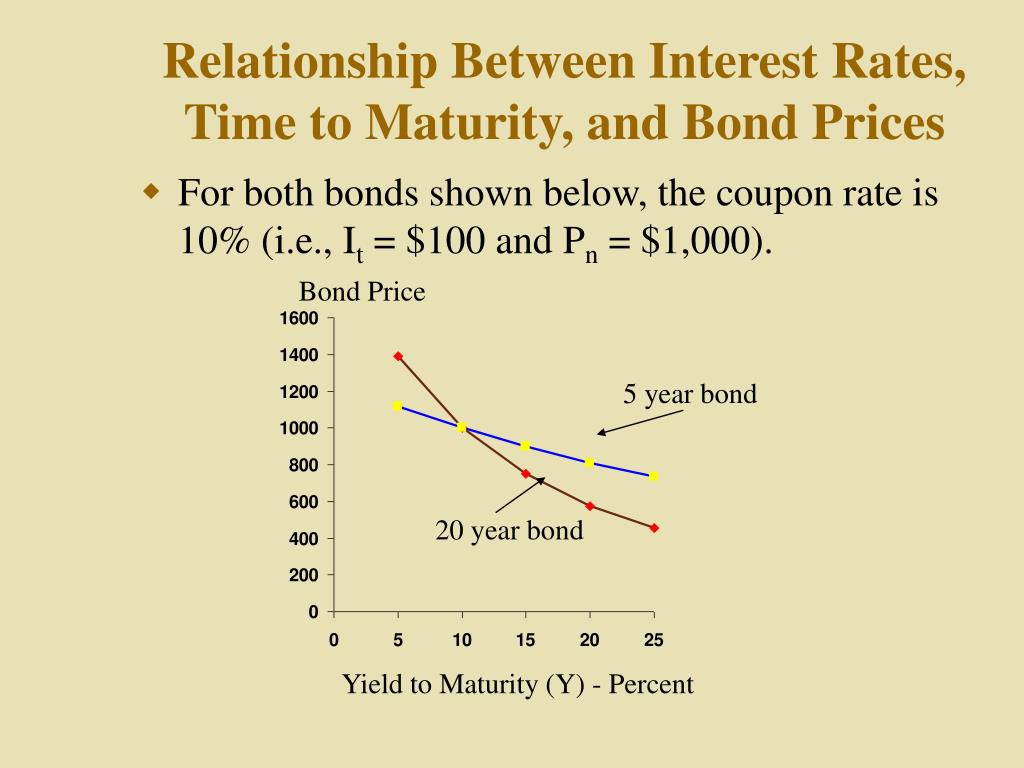

How do you calculate the interest rate of a bond? Each year, the bond pays 10%, or $100, in interest. Its coupon rate is the interest divided by its par value. If interest rates rise above 10%, the bond's price will fall if the investor decides to sell it. For example, imagine interest rates for similar investments rise to 12.5%. Bond Prices, Rates, and Yields - Fidelity While you own the bond, the prevailing interest rate rises to 7% and then falls to 3%. 1. The prevailing interest rate is the same as the bond's coupon rate. The price of the bond is 100, meaning that buyers are willing to pay you the full $20,000 for your bond. 2. Prevailing interest rates rise to 7%. Buyers can get around 7% on new bonds, so ... Coupon Rate Calculator | Bond Coupon For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued.. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Hence, a higher coupon rate bond, in general, provides better ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing For example, if the face value of a bond is $1,000 and its coupon rate is 2%, the interest income equals $20. Whether the economy improves, worsens, or remains the same, the interest income does not change. Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%).

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities. How is YTM related to coupon rate? - Skinscanapp.com A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of issuance, as determined by the issuing entity. Most bonds have par values of $100 or $1,000. Coupon Interest and Yield for eTBs - australiangovernmentbonds What is the Coupon Interest Rate? The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Solved Bond A has a coupon rate of 10%, and Bond B has a | Chegg.com Bond A has a coupon rate of 10%, and Bond B has a coupon rate of 2%. Bonds A's price is less interest rate sensitive than Bond 's price (on a percent change basis) True False; Question: Bond A has a coupon rate of 10%, and Bond B has a coupon rate of 2%. Bonds A's price is less interest rate sensitive than Bond 's price (on a percent change ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Readers who read this also read: Difference Between Coupon Rate and Discount Rate

Series I Savings Bonds Rates & Terms: Calculating Interest Rates The composite rate for I bonds issued from May 2022 through October 2022 is 9.62 percent. This rate applies for the first six months you own the bond. How do I bonds earn interest? An I bond earns interest monthly from the first day of the month in the issue date.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

What Is Coupon Rate and How Do You Calculate It? The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons.

Post a Comment for "38 bond coupon interest rate"