43 a 10 year bond with a 9 annual coupon

en.wikipedia.org › wiki › Government_bondGovernment bond - Wikipedia For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% of the $20,000 each year. At the maturity date the government would give back the original $20,000. [Solved] A bond that matures in 10 years has a 1000 par value The ... The annual coupon interest rate is 9 percent and the market's required yield to maturity on a comparable-risk bond is 15 percent. What would be the value of this bond if it paid interest annually? ... The market price is $1,200 for a 10-year bond ($1,000 par value) that pays 9 percent annual interest, but makes interest payments on a semiannual ...

› investing › bondTMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch Nov 13, 2022 · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

A 10 year bond with a 9 annual coupon

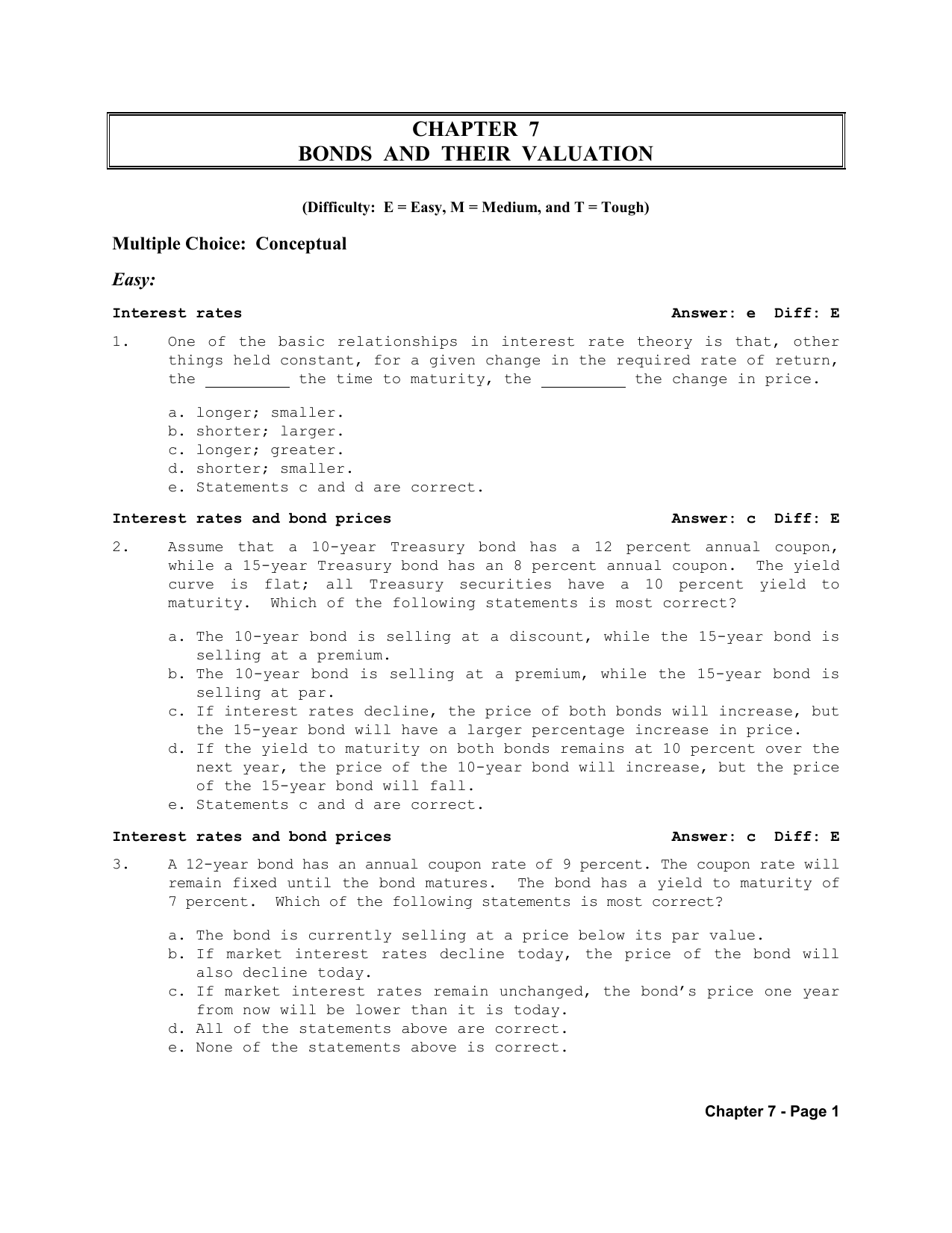

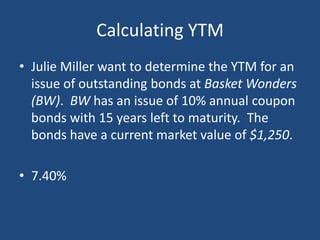

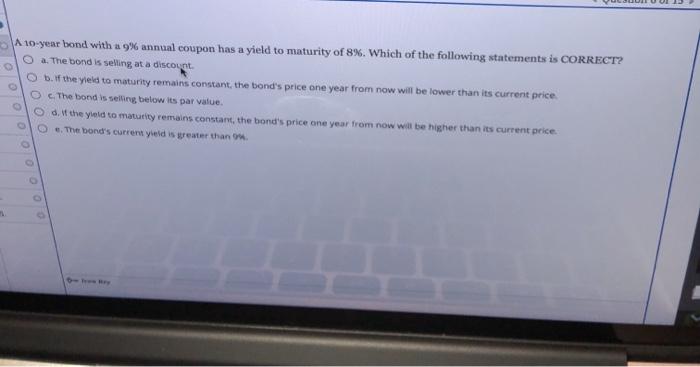

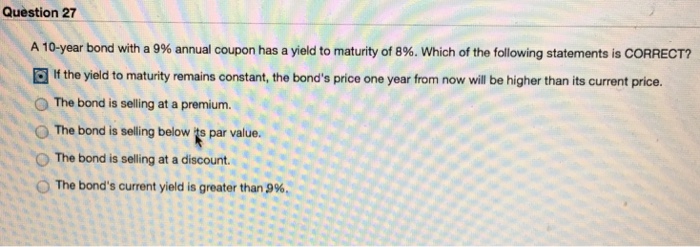

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered • expert verified A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Solved 1) A 10-year bond with a 9% annual coupon has a yield - Chegg Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved! 10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

A 10 year bond with a 9 annual coupon. Finance Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. The bond's current yield is greater than 9%. c. Answered: A 10-year bond with a 9% annual coupon… | bartleby Business Finance QA Library A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. Answered: A 10-year bond with a 9% annual coupon… | bartleby The bond is selling below its par value. The bond is selling at a discount. The bond's current yield is greater than 9%. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is ... Credit default swap - Wikipedia The "spread" of a CDS is the annual amount the protection buyer must pay the protection seller over the ... The left axis is basis points, or 100ths of a percent; a level of 1,000 means it costs $1 million per year to protect $10 million of debt for five years. ... 9.5 2009-06-10: Georgia Gulf LCDS: 83 2009-06-11: R.H. Donnelley Corp. CDS: 4. ...

Publication 550 (2021), Investment Income and Expenses You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. 10. Banks, money, and the credit market – The Economy - CORE And if ‘later’ means in one year from now, then the annual interest rate, r, is: ... 10.9 The central bank, the money market, and interest rates interest rate (short-term) ... In contrast, we know the price of a bond, its coupon payments, and its face value, so we can always calculate a bond’s yield. Interest Rate Statistics | U.S. Department of the Treasury Budget Request/Annual Performance Plan and Reports. ... Treasury Coupon Issues. Corporate Bond Yield Curve. Federal Financial Data. Your Guide to America’s Finances. ... 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an ... [Solved] Bond X is a premium bond making annual pa | SolutionInn Bond X is a premium bond making annual payments. The bond pays a 9% coupon, has a YTM of 7%, and has 13 years to maturity. Bond Y is a discount bond making annual payments. This bond pays a 7% coupon, has a YTM of 9%, and also has 13 years to maturity. If interest rates remain unchanged, what do

› the-economy › book10. Banks, money, and the credit market – The Economy - CORE Question 10.2 Choose the correct answer(s) Mr Bond has wealth of £500,000. He has a market income of £40,000 per year, on which he is taxed 30%. Mr Bond’s wealth includes some equipment, which depreciates by £5,000 every year. Based on this information, which of the following statements is correct? Mr Bond’s disposable income is £40,000. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its › publications › p550Publication 550 (2021), Investment Income and Expenses ... You bought a 10-year bond with a stated redemption price at maturity of $1,000, issued at $980 with OID of $20. One-fourth of 1% of $1,000 (stated redemption price) times 10 (the number of full years from the date of original issue to maturity) equals $25. Because the $20 discount is less than $25, the OID is treated as zero. › 10-year-treasury-note10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

Government bond - Wikipedia A government bond or sovereign bond is a debt obligation issued by a national government to support government spending.It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date. For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual …

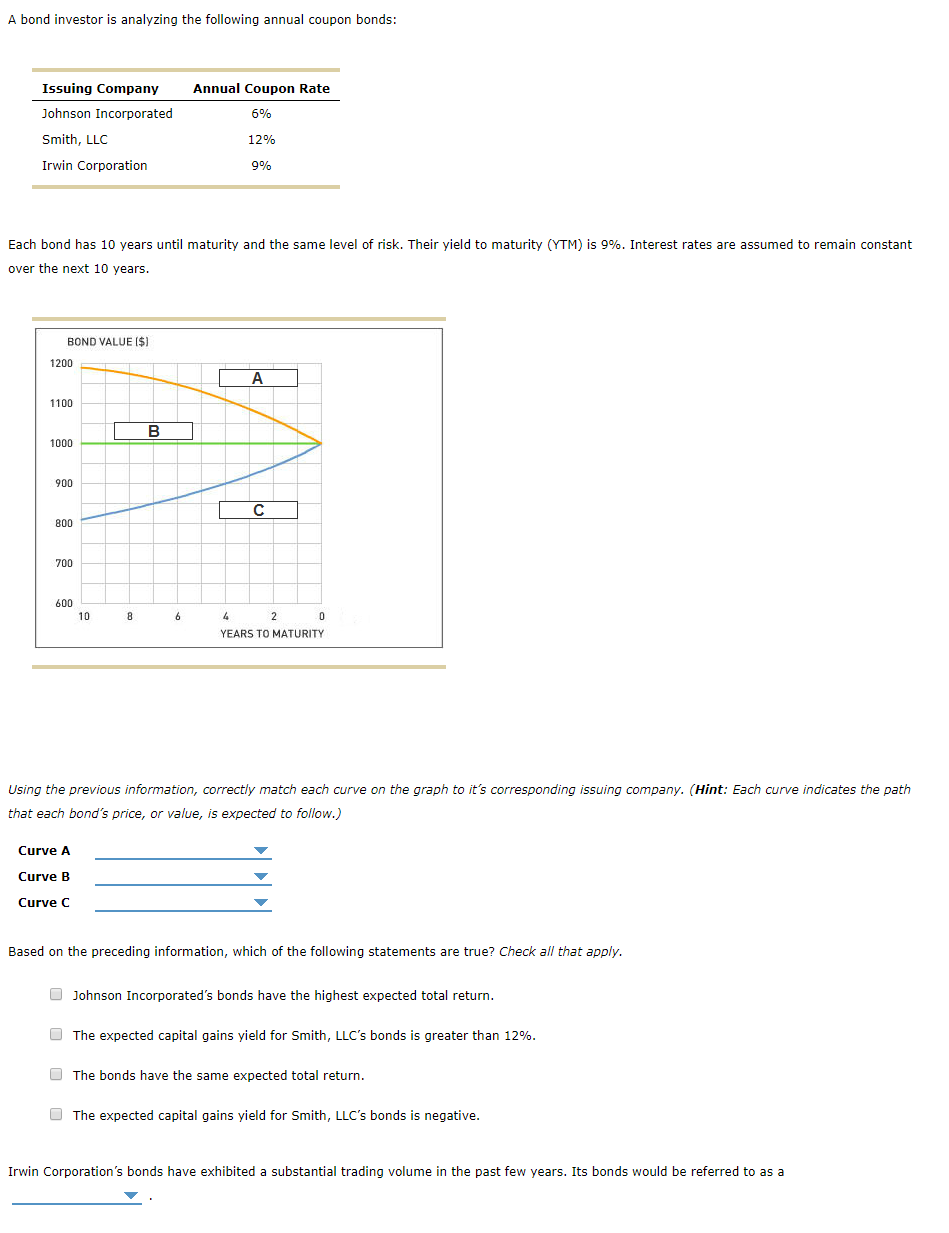

A 10 year corporate bond has an annual coupon of 9 A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is INCORRECT? a. The bond's expected capital gains yield is positive. b. The bond's yield to maturity is 9%. c. The bond's current yield is 9%. d. The bond's current yield exceeds its capital gains yield ...

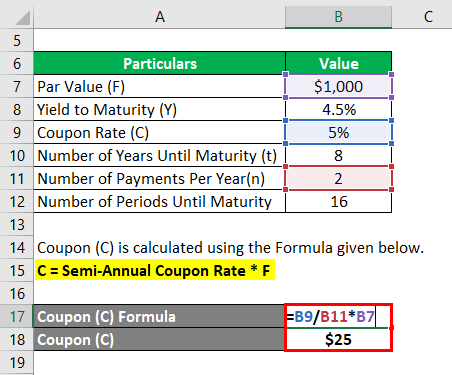

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

› archivesArchives - Los Angeles Times You can also browse by year and month on our historical sitemap. Searching for printed articles and pages (1881 to the present) Readers can search printed pages and article clips going back to ...

FINN 3226 CH. 4 Flashcards | Quizlet A A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b.

home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

North County - The San Diego Union-Tribune Nov 12, 2022 · News from San Diego's North County, covering Oceanside, Escondido, Encinitas, Vista, San Marcos, Solana Beach, Del Mar and Fallbrook.

A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? If Ask an Expert Tax Questions Finance Questions A 10-year bond with a 9% annual coupon has a yield to maturity… Satisfied Customers Related Finance Questions When a bond's yield to maturity is less than the bond's

TMUBMUSD30Y | U.S. 30 Year Treasury Bond Overview | MarketWatch Nov 11, 2022 · 6 month- through 20-year Treasury yields all jump further above 4% after September CPI; 10-year rate hovers at 4.06% Oct. 13, 2022 at 9:25 a.m. ET by MarketWatch

Archives - Los Angeles Times You can also browse by year and month on our historical sitemap. Searching for printed articles and pages (1881 to the present) Readers can search printed pages and article clips going back to ...

[Solved]: A 25 -year bond with an \( 9 \% \) annual coupon A 25 -year bond with an \ ( 9 \% \) annual coupon has a yield to maturity of \ ( 9 \% \). Which of the following statements is correct? The bond is selling at par. The bond is selling at a discount. The bond is selling at a premium. The bond's current yield is less than \ ( 9 \% \). The expected capital gains yield on this bond is positive.

TMUBMUSD10Y | U.S. 10 Year Treasury Note Overview | MarketWatch 1 day ago · TMUBMUSD10Y | A complete U.S. 10 Year Treasury Note bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

A 10 year bond with a 9 annual coupon has a yield to A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value.c. The bond is selling at a discount. d.

10-Year Treasury Note and How It Works - The Balance Mar 24, 2022 · It's easy to confuse the fixed annual interest rate—the "coupon yield"—with the "yield to maturity" quoted daily on the 10-year treasury. Many people refer to the yield as the Treasury Rate. When people say "the 10-year Treasury rate," they don't always mean the fixed interest rate paid throughout the life of the note. They often mean the ...

Solved 1) A 10-year bond with a 9% annual coupon has a yield - Chegg Question: 1) A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling at a premium to par value. b. The bond is selling at a discount. c. The bond is selling below its par value. d. The bond will earn a rate of return greater than 8%. This problem has been solved!

A 10-year bond with a 9% annual coupon has a yield to maturity of 8% ... answered • expert verified A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Post a Comment for "43 a 10 year bond with a 9 annual coupon"