41 find the coupon rate of a bond

What Is the Coupon Rate of a Bond? - The Balance The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Rate Formula & Calculation - Study.com Coupon Rate Formula. To calculate the coupon rate, these steps should be followed: Identify the par value of the bond. Usually, the par value of the bond equals $1,000.

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

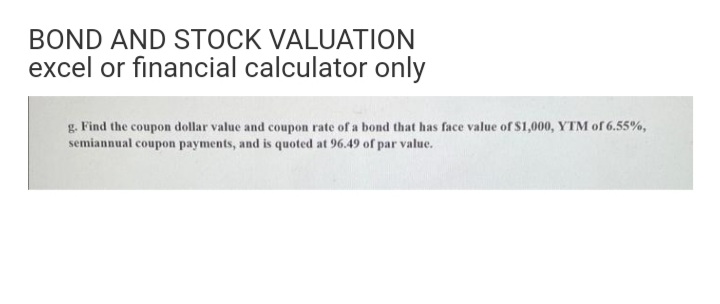

Find the coupon rate of a bond

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ... Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

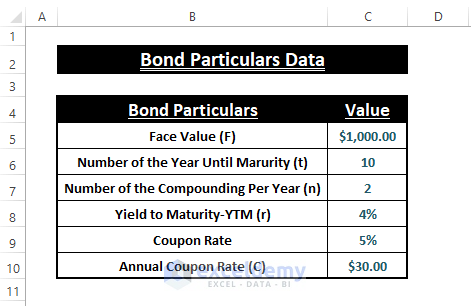

Find the coupon rate of a bond. What Is a Coupon Rate? How To Calculate Them & What They're Used For A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each ... Coupon Rate Structure of Bonds — Valuation Academy Some of the most common types of Bonds based on their coupon rate structures are: 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40 ... Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the Coupon Rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity

What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example,... Bond Pricing - Formula, How to Calculate a Bond's Price Each payment is discounted to the current time based on the yield to maturity (market interest rate). The price of a bond is usually found by: P (T0) = [PMT (T1) / (1 + r)^1] + [PMT (T2) / (1 + r)^2] … [ (PMT (Tn) + FV) / (1 + r)^n] Where: P (T0) = Price at Time 0 PMT (Tn) = Coupon Payment at Time N FV = Future Value, Par Value, Principal Value What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value... Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Bond - Guide, Examples, How Coupon Bonds Work The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Also, the slightly modified formula of the present value of an ordinary annuity can be used as a shortcut for the formula above, since the payments on this type of bond are fixed and set over fixed time periods: More Resources Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Longer duration bonds are more sensitive to shifts in interest rates. And zero-coupon long duration bonds are more sensitive to rate shifts than bonds which regularly pay interest. Typically the yield curve is upward sloping with longer duration bonds offering a higher return to compensate for the added risk. When shorter duration bonds offer a ...

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond.

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Calculate the Coupon Rate of a Bond - YouTube 0:00 / 2:44 Calculate the Coupon Rate of a Bond 33,837 views Jul 25, 2018 This video explains how to calculate the coupon rate of a bond when you are given all of the other terms...

Create function in R to find coupon rate for bond c_rate <- function (bond_value, par, ttm, y) { t <- seq (1, ttm, 1) pv_factor <- 1 / (1 + y)^t cr <- (bond_value - par / (1+y)^t) / (par*sum (pv_factor)) cr } however, this yields multiple results. How can i update the function to only yield one the final index only? r algorithm Share Follow edited Apr 12, 2020 at 17:05

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Coupon Bond Formula | Examples with Excel Template - EDUCBA The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. As per the current market trend, the bonds with similar risk profile have yielded to maturity of 6%. Calculate the market price of the bonds based on the given information.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

How to Calculate Bond Price in Excel (4 Simple Ways) Use the below formula in the C11 cell to find the Coupon Bond price. =C10* (1- (1+ (C8 /C7))^ (-C7*C6 ))/ (C8/C7)+ (C5/ (1 + (C8/C7))^ (C7*C6)) Use the ENTER key to display the Coupon Bond Price. 🔄 Zero-Coupon Bond Price Calculation Also, using the conventional formula you can find the zero-coupon bond price.

How To Find Coupon Rate Of A Bond On Financial Calculator To calculate the coupon rate on a financial calculator, enter the face value of the bond and then press the 'Coupon' or 'CP' button. This will bring up a list of different coupon rates. Find the coupon rate that matches the interest rate on your bond and press enter. The COUP function will then calculate the coupon rate for you. Formula: C=PZ ^ k

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

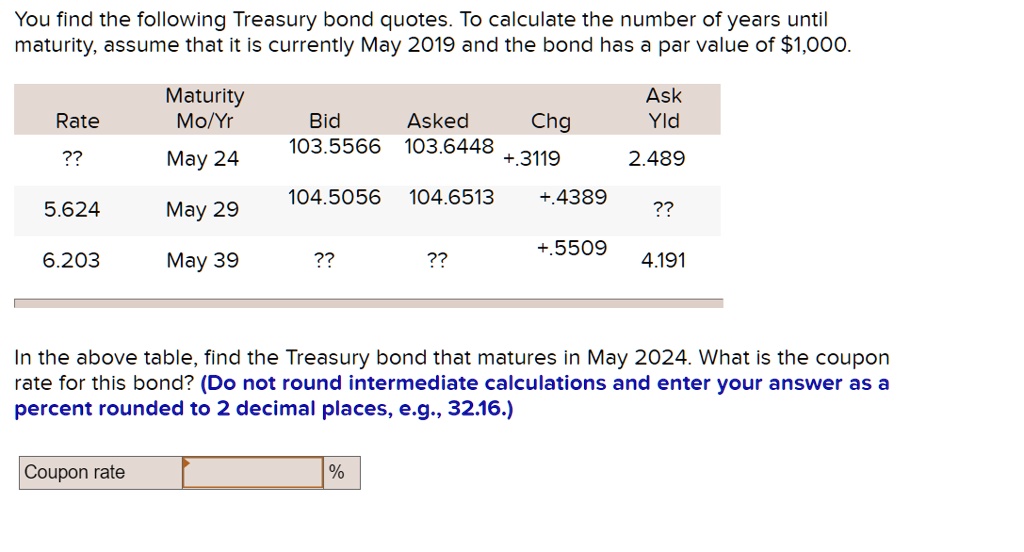

![Solved Problem 6-33 Coupon Rates (LO 2] You find the | Chegg.com](https://media.cheggcdn.com/media/f0d/f0d3e3cc-89c9-4eed-b5c1-9f247c01695c/php2LGFUe.png)

![Solved Problem 6-33 Coupon Rates [LO 2] You find the | Chegg.com](https://d2vlcm61l7u1fs.cloudfront.net/media%2Ff03%2Ff03d6014-74fb-4eaa-925c-f616ab6ad67e%2FphpfU7HCp.png)

Post a Comment for "41 find the coupon rate of a bond"