39 suppose you bought a bond with an annual coupon of 7 percent

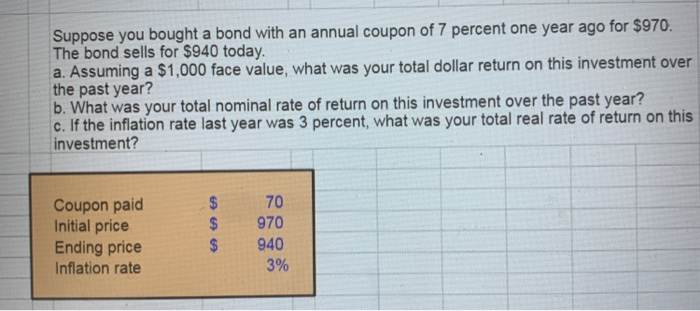

[Solved]: Suppose you bought a \( 7.6 \) percent (annually) Suppose you bought a \( 7.6 \) percent (annually) coupon bond one year ago for \( \$ 840 \). The bond sells for \( \$ 885 \) today. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit \( \$ \) sign in your response.) a. [Solved] Suppose you bought a bond with an annual coupon of 7 percent ... Answer to Suppose you bought a bond with an annual coupon of 7 percent one year ago for $970. The bond sells for $940 today. a. Assuming a $1,000 face value, what was you | SolutionInn

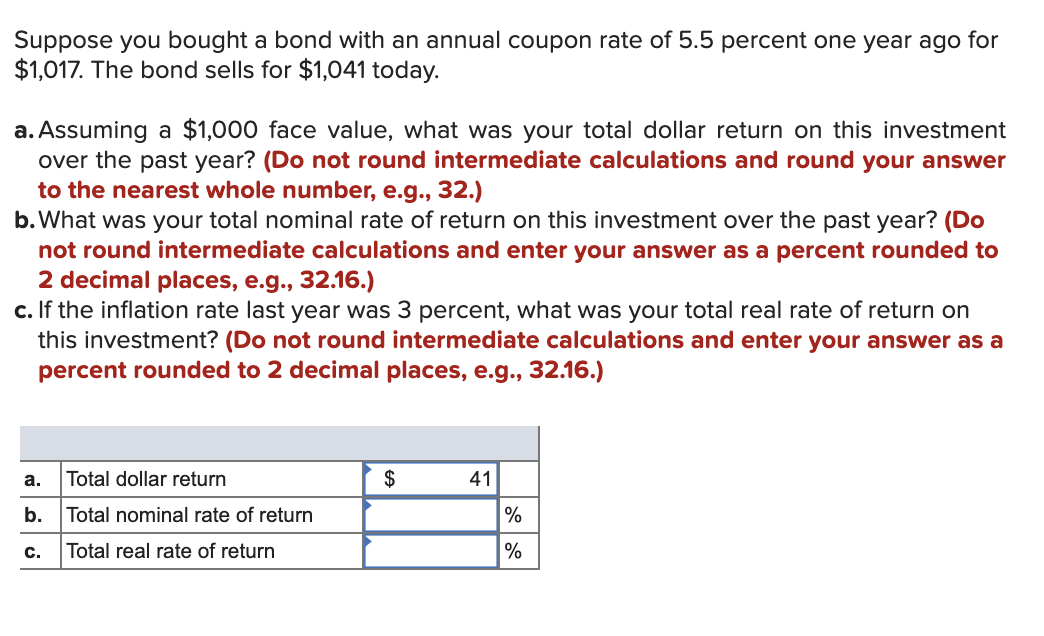

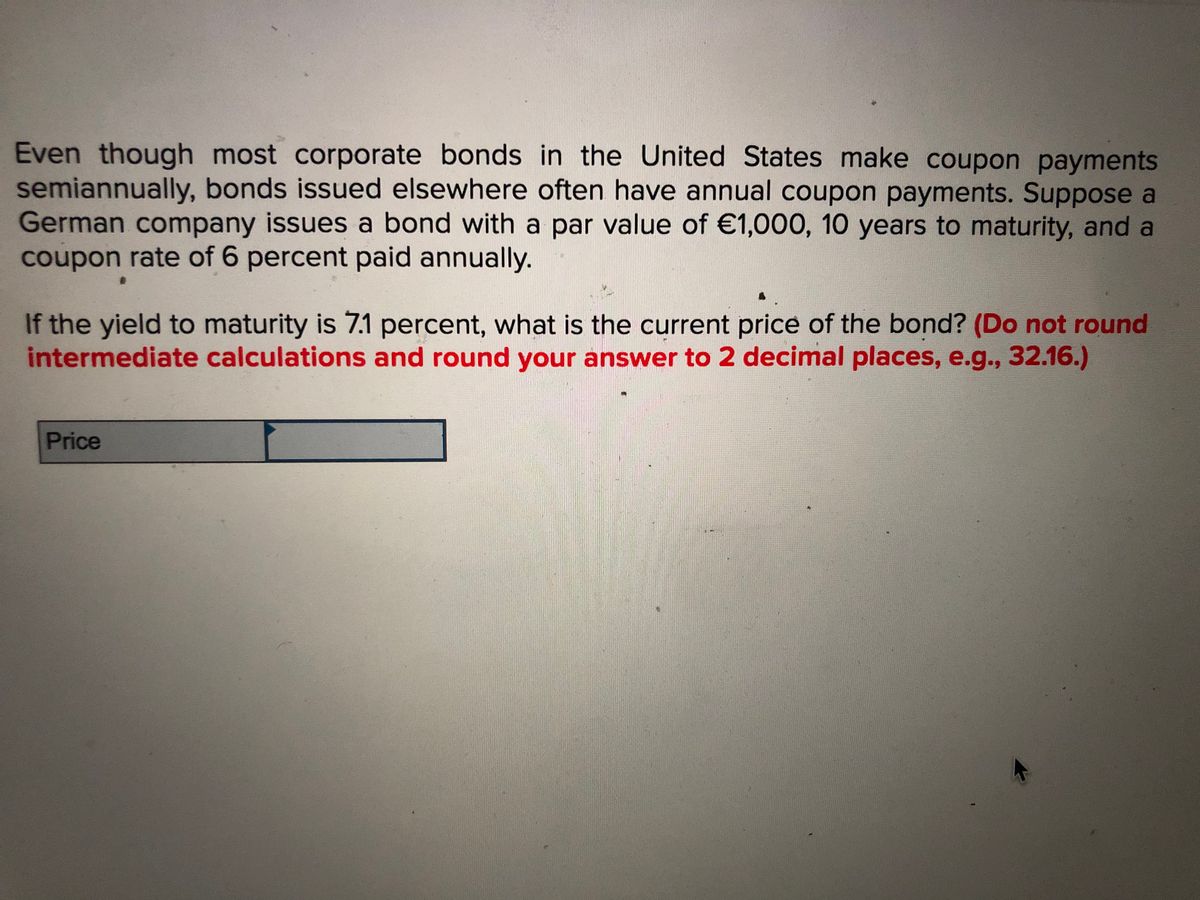

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a.Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b.What was your total nominal rate of return on this investment over the past year?

Suppose you bought a bond with an annual coupon of 7 percent

Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what - 14088611 Solved Suppose you bought a bond with an annual coupon rate - Chegg Suppose you bought a bond with an annual coupon rate of 7.2 percent one year ago for $895. The bond sells for $922 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Solved Suppose you bought a bond with an annual coupon rate | Chegg.com Suppose you bought a bond with an annual coupon rate of 7.4 percent one year ago for $900. The bond sells for $940 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Total dollar return. $.

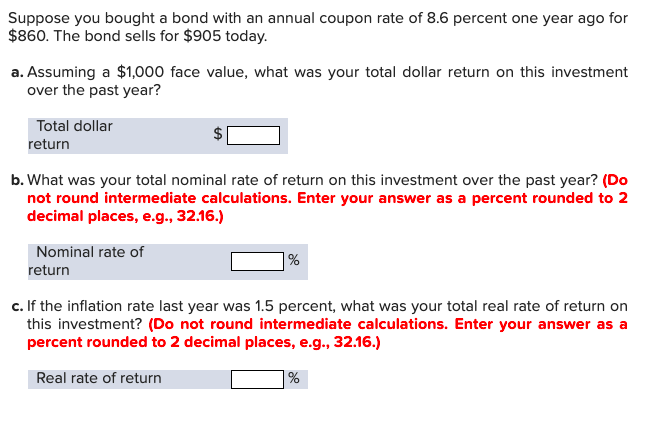

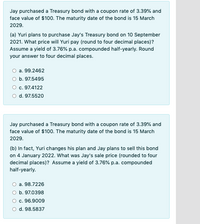

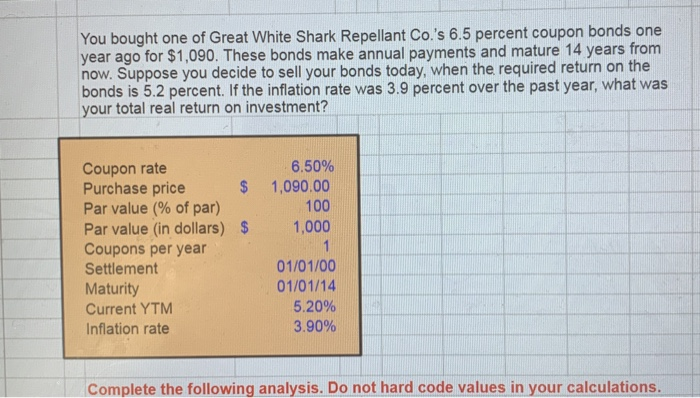

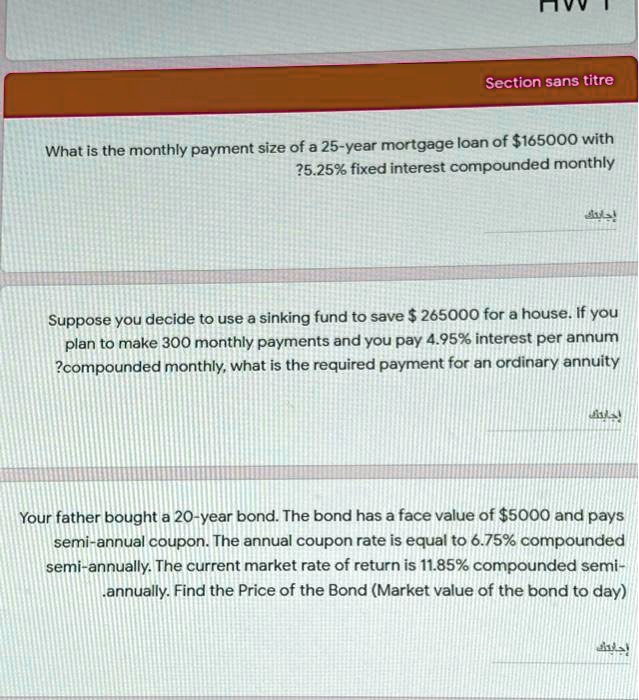

Suppose you bought a bond with an annual coupon of 7 percent. Chapter 7 Flashcards | Quizlet Suppose that today you buy a bond with an annual coupon of 7 percent for $1,090. The bond has 14 years to maturity. A) What rate of return do you expect to earn on your investment? Assume a par value of $1,000. B) What is the HPY on your investment? (your realized return is known as the holding period yield) Question : Question Suppose you bought a bond with an annual coupon ... The bond sells for $905 today. a. Assuming a $1,000... Question Suppose you bought a bond with an annual coupon rate of 8.8 percent one year ago for $911. The bond sells for $954 today. a. Assuming... Q2uestion Suppose you bought a computer for $5,000 three years ago. It isdepreciated as a three-year property class, where the percentagesare 33. ... 2.docx - 2- Interpreting Bond Yields Suppose you buy a 7 percent coupon ... 2-Interpreting Bond Yields Suppose you buy a 7 percent coupon, 20-year bond today when it's first issued.If interest rates suddenly rise to 15 percent, what happens to the value of your bond? Why? 5-Coupon Rates Nikita Enterprises has bonds on the market making annual payments, with eight years to maturity, a par value of $1,000, and selling for $962. . At this price, the bonds yield 5.1 perce Solved Suppose you bought a bond with a coupon rate of 6.2 - Chegg Suppose you bought a bond with a coupon rate of 6.2 percent paid annually one year ago for $900. The bond sells for $930 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)

Chapter 10 Finance Flashcards | Quizlet Suppose a stock had an initial price of $121 per share, paid a dividend of $3.30 per share during the year, and had an ending share price of $153. ... Suppose you bought a bond with an annual coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. a. Assuming a $1,000 face value, what was your total dollar return on ... Solved Suppose you bought a bond with an annual coupon rate - Chegg See the answer. Suppose you bought a bond with an annual coupon rate of 8.7 percent one year ago for $910. The bond sells for $952 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. 1.docx - Suppose you bought a bond with an annual coupon rate of 7.9 ... View 1.docx from FIN 737 at Columbus State Community College. Suppose you bought a bond with an annual coupon rate of 7.9 percent one year ago for $902. The bond sells for $936 Solved Suppose you bought a bond with an annual coupon of 7 - Chegg Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? b. What was your total nominal rate of return on this investment over the past year? (Do not round intermediate calculations.

Solved Suppose you bought a bond with a coupon rate of 7.8 - Chegg Suppose you bought a bond with a coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. Required: Question: Suppose you bought a bond with a coupon rate of 7.8 percent one year ago for $901. The bond sells for $934 today. Required: Solved Suppose you bought a bond with an annual coupon rate | Chegg.com Suppose you bought a bond with an annual coupon rate of 7.4 percent one year ago for $900. The bond sells for $940 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? Total dollar return. $. Solved Suppose you bought a bond with an annual coupon rate - Chegg Suppose you bought a bond with an annual coupon rate of 7.2 percent one year ago for $895. The bond sells for $922 today. a. Assuming a $1,000 face value, what was your total dollar return on this investment over the past year? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Suppose you bought a bond with an annual coupon of 7 percent one year ... Suppose you bought a bond with an annual coupon of 7 percent one year ago for $1,010. The bond sells for $985 today. a. Assuming a $1,000 face value, what - 14088611

![Answered: 4. Calculating Returns [LO1] Suppose… | bartleby](https://content.bartleby.com/qna-images/question/4ed9bdea-3a41-49ec-a684-f00d4b6b8d3d/8fd2ac2f-5447-46a5-acf3-3441dc616c9a/0aq6elm.png)

Post a Comment for "39 suppose you bought a bond with an annual coupon of 7 percent"