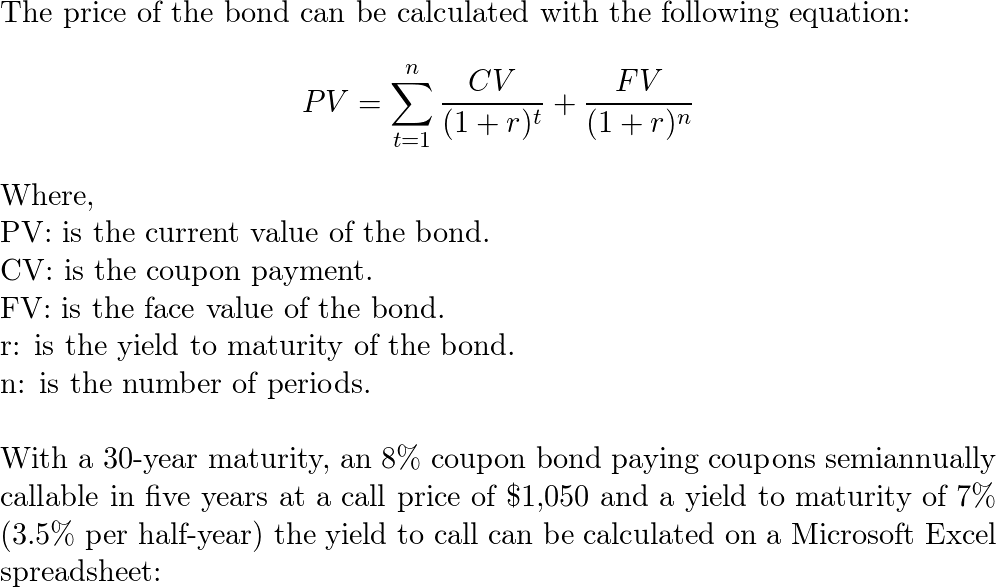

43 yield to maturity of coupon bond

› terms › bBond Yield: What It Is, Why It Matters, and How It's Calculated May 31, 2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... en.wikipedia.org › wiki › Yield_to_maturityYield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

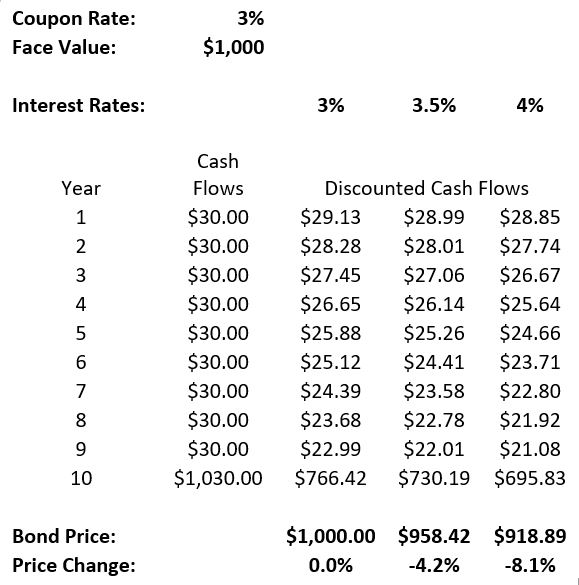

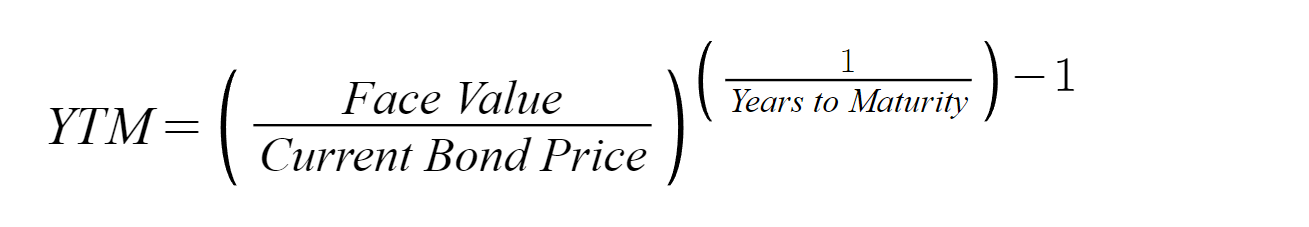

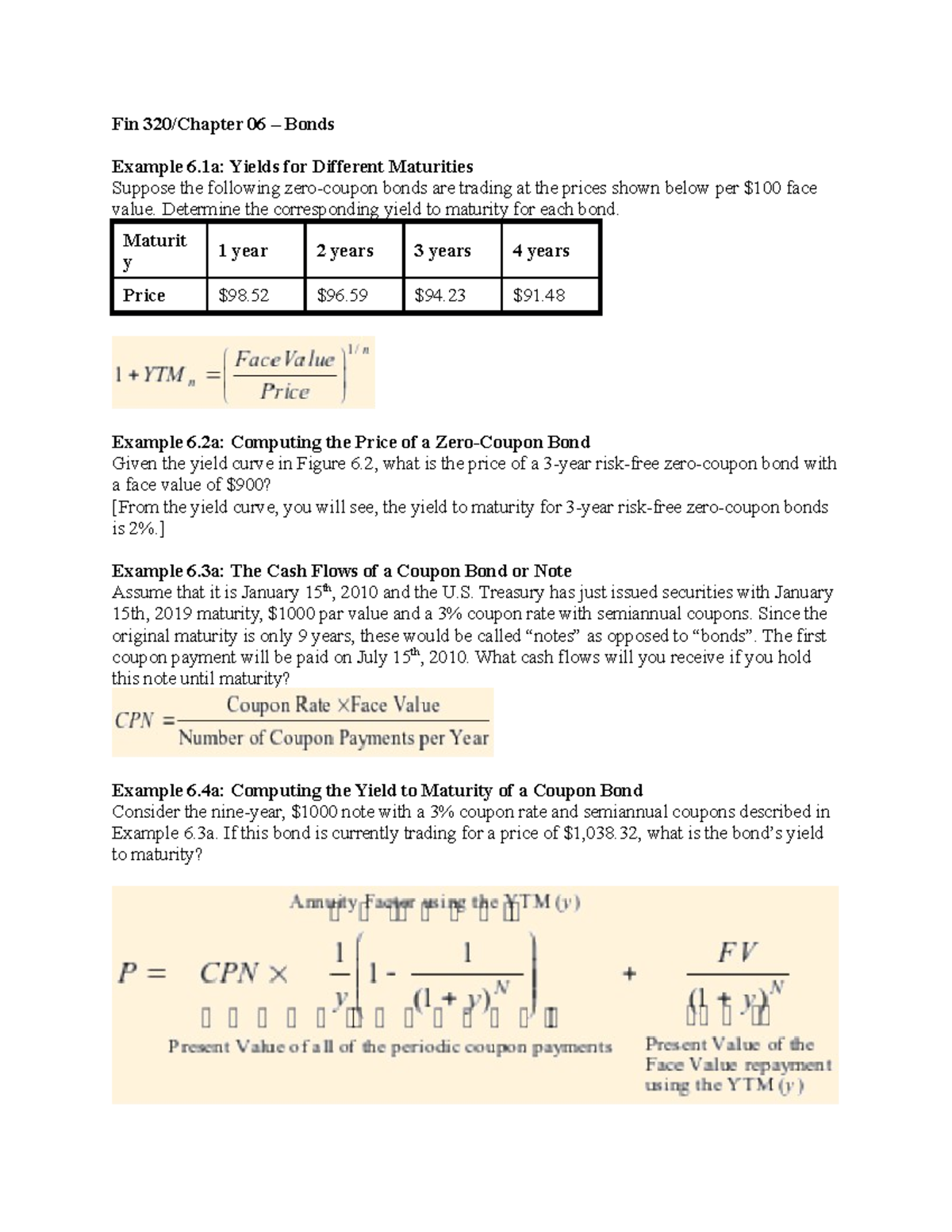

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Yield to maturity of coupon bond

› terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Yield to worst on a non-callable bond is exactly equal to the yield to maturity. On a callable bond, it is the lower of the yield to maturity and yield to call. For other calculators in our financial basics series, please see: Compound Interest Calculator; Present Value Calculator; Compound Annual Growth Rate Calculator; Bond Pricing Calculator › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond.

Yield to maturity of coupon bond. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... › bonds › 07Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Yield to worst on a non-callable bond is exactly equal to the yield to maturity. On a callable bond, it is the lower of the yield to maturity and yield to call. For other calculators in our financial basics series, please see: Compound Interest Calculator; Present Value Calculator; Compound Annual Growth Rate Calculator; Bond Pricing Calculator › terms › yYield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

Post a Comment for "43 yield to maturity of coupon bond"