45 valuing zero coupon bonds

Zero-Coupon Bond Definition - Investopedia If the debtor accepts this offer, the bond will be sold to the investor at $20,991 / $25,000 = 84% of the face value. Upon maturity, the investor gains $25,000 - $20,991 = $4,009, which translates... Chapter 12: The Cost of Capital - California State University, … Title: Chapter 12: The Cost of Capital Subject: Gallagher and Andrew Author: Gallagher Last modified by: kuhlejl Created Date: 6/19/1997 4:16:34 PM

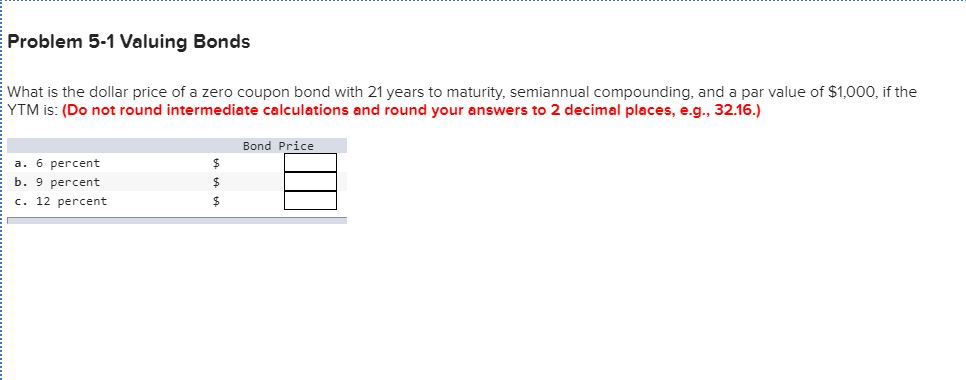

Valuation Of Zero Coupon Bond And Handling Semi Annual Compounding ... The value of a zero coupon bond is determined by its face value, maturity date, and the prevailing interest rate. the formula to calculate the value of a zero coupon bond is. price = m (1 r)n. where: m = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Valuing zero coupon bonds

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest that will be earned over the 10-year life ... Zero - Coupon Bonds - Economy Blatt Zero - coupon bonds are also called pure discount bonds as they trade at a discount, a price lower than the face value prior to its maturity date. Suppose you have purchased a one - year, risk - free, zero coupon bond which has an initial price of $ 144,927. The face value of the bond is $150,000. Reserve Bank of India - Frequently Asked Questions STRIPS in G-Secs ensure availability of sovereign zero coupon bonds, which facilitate the development of a market determined zero coupon yield curve (ZCYC). STRIPS also provide institutional investors with an additional instrument for their asset liability management (ALM). Further, as STRIPS have zero reinvestment risk, being zero coupon bonds, they can be …

Valuing zero coupon bonds. Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Fundamentals of Finance | Coursera Holding Period Return and Yield to Maturity for Zero-Coupon Bonds 10m. Calculating the Holding Period Return on a Coupon Bond 10m. Topic 3 Lecture Slides 10m. Topic 3 Lecture Notes 10m. 1 practice exercise. Module 2 Quiz 30m. Week. 3. Week 3. 2 hours to complete. Module 3 - Equity Valuation. In this module, you’ll examine how to determine the value of stocks using present … ACCT 223 | Chapter 7 Flashcards | Quizlet 2. Characteristics of Bonds a. A bond's _____ is generally $1,000 and represents the amount borrowed from the bond's first purchaser. b. A bond issuer is said to be in _____ if it does not pay the interest or the principal in accordance with the terms of the indenture agreement or if it violates one or more of the issue's restrictive covenants. What are bond spreads? - Financial Pipeline 19.02.2016 · For example, an investor can buy Province of Ontario “zero coupon” bonds for the same maturity date in three different forms: 1) a “coupon” which is a stripped coupon payment from an Ontario bond; 2) a “residual” which is the stripped principal payment from an Ontario bond; and 3) an actual zero-coupon Ontario Global bond issue which was originally issued as a …

Example valuing a zero coupon bond compute the value The bond values corresponding to required yields of 3%, 6%, and 12% as the bond approaches maturity are presented in Figure 1. The change in value associated with the passage of time for the three bonds represented in Figure 1 is presented graphically in Figure 2. ©20 12 Kaplan, Inc. Page 91 Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months. Zero-Coupon Bonds: Definition, Formula, Example, Advantages, and ... A zero-coupon bond can be described as a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder ... Bond valuation and bond yields | P4 Advanced Financial … The plain vanilla bond with annual coupon payments in the above example is the simpler type of bond. In addition to the plain vanilla bond, candidates – as part of their Advanced Financial Management studies and exam – are required to have knowledge of, and be able to deal with, more complicated bonds such as: bonds with coupon payments occurring more frequently than once a year ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) PDF Numerical Example in Valuing Zero coupon Bonds - New York University For example, the value of a zero coupon bond will increase from $385.00 to $620.92 as the bond moves from 10 years to maturity to 5 years to maturity assuming interest rates remain at 10%. 4) Compare the value of the zero at 10 years to maturity when rates are 10% versus when they are 7%. Lower interest rates mean higher bond prices. Swaps in Finance | Definition | Examples | Valuation Types of Swaps in Finance. There are several types of Swaps transacted in the financial world. They are a commodity, currency, volatility, debt, credit default, puttable, swaptions, Interest rate swap, equity swap Equity Swap Equity Swaps is defined as a derivative contract between two parties that involve the exchange of future cash flows. There are two basis of determining cash … Zero Coupon Bonds Explained (With Examples) - Fervent Valuing Zero Coupon Bonds on Excel® We'll be using Excel's "PRICE" function to value Swindon Plc's bond. The first thing you want to do is setup your spreadsheet with a pro-forma / template that consists of the all different variables you'll need. The "PRICE" function on Excel® requires:

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

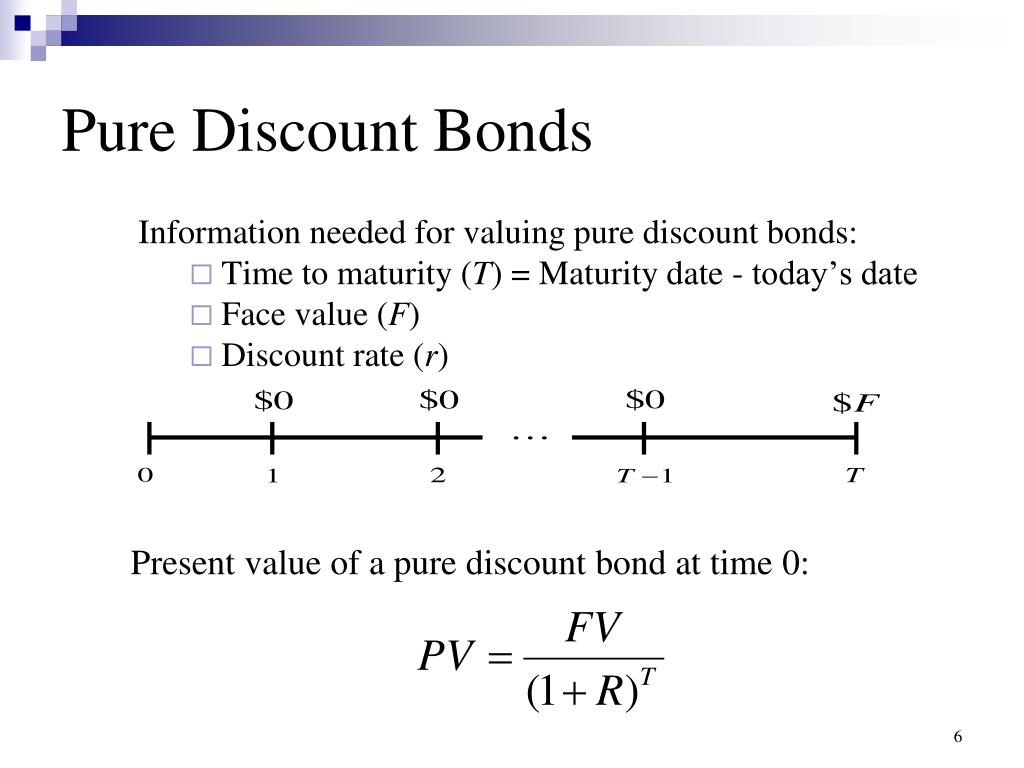

Valuing a zero-coupon bond | Mastering Python for Finance - Packt Zero-coupon bonds are also called pure discount bonds. A zero-coupon bond can be valued as follows: Here, y is the annually-compounded yield or rate of the bond, and t is the time remaining to the maturity of the bond. Let's take a look at an example of a five-year zero-coupon bond with a face value of $ 100. The yield is 5%, compounded annually.

What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond is a discounted investment that can help you save for a specific future goal. Tara Mastroeni. Updated. Jul 28, 2022, 9:13 AM. Buying zero-coupon bonds can be a good deal for ...

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Chapter 7 -- Stocks and Stock Valuation - California State … Valuing a corporation Preferred stock The efficient market hypothesis (EMH) Characteristics of common stock Ownership in a corporation: control of the firm Claim on income: residual claim on income Claim on assets: residual claim on assets Commonly used terms: voting rights, proxy, proxy fight, takeover, preemptive rights, classified stock, and limited liability The market price …

Zero Coupon Bond Calculator - What is the Market Value? A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). The entire face value of the bond is paid out at maturity. It is also known as a deep discount bond. Benefits and Drawbacks of Zero Coupon Bonds

Understanding Zero Coupon Bonds - Part One - The Balance Here are some general characteristics of zero coupon bonds: Issued at deep discount and redeemed at full face value. Some issuers may call zeros before maturity. You must pay tax on interest annually even though you don't receive it until maturity. Zero coupon bonds are more volatile than regular bonds. Of the three kinds of zero coupon bonds ...

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The zero-coupon bond value refers to the current value of a zero-coupon bond. This formula requires three variables: face value, interest rate and the number of years to maturity. The zero-coupon bond value is usually expressed as a monetary amount. This equation is sensitive to interest rate fluctuations.

How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000...

SOPHIA PATHWAYS Principles of Finance unit 2 - Quizlet b.)Longer-term bonds are less sensitive to interest rate risk than shorter-term bonds. c.)Bonds held until maturity have greater exposure to interest rate risk. d.)It stems from the fact that coupon rates and market interest rates are directly correlated.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

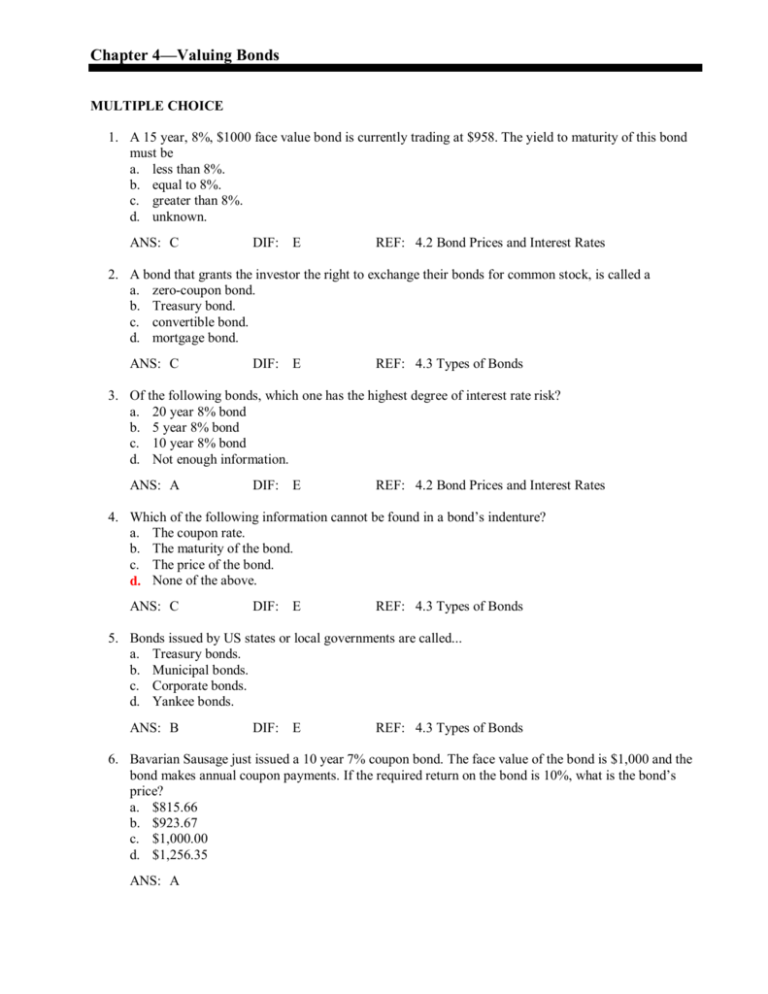

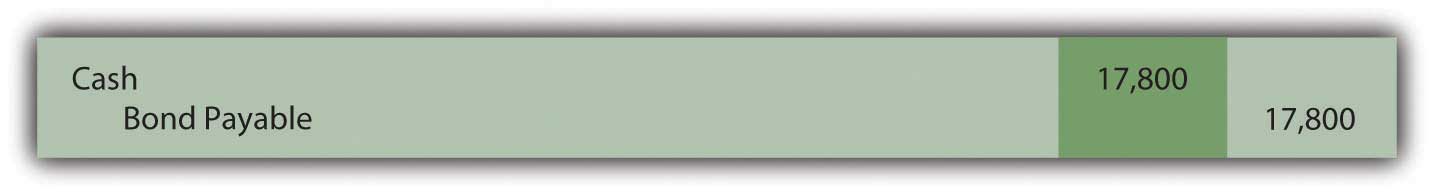

Valuing Bonds | Boundless Accounting | | Course Hero A bond's coupon is the interest rate that the business must pay on the bond's face value. These interest payments are generally paid periodically during the bond's term, although some bonds pay all the interest it owes at the end of the period. While the coupon rate is generally a fixed amount, it can also be "indexed.

Valuation Of Zero Coupon Bonds - Otosection The value of a zero coupon bond is determined by its face value, maturity date, and the prevailing interest rate. the formula to calculate the value of a zero coupon bond is. price = m (1 r)n. where: m = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

All the 21 Types of Bonds | General Features and Valuation | eFM 13.06.2022 · Different Types of Bonds Plain Vanilla Bonds. A plain vanilla bond is a bond without unusual features; it is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value. It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon …

:brightness(10):contrast(5):no_upscale()/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "45 valuing zero coupon bonds"