38 zero coupon bonds tax

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond- (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day of June, 2005; What is the tax implication on zero coupon bonds? - myITreturn Help Center Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ...

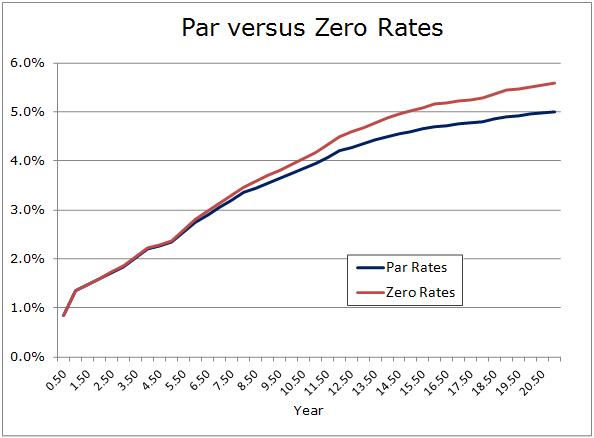

Government - Continued Treasury Zero Coupon Spot Rates* Aug 14, 2013 · Continued Treasury Zero Coupon Spot Rates* ... IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates.

Zero coupon bonds tax

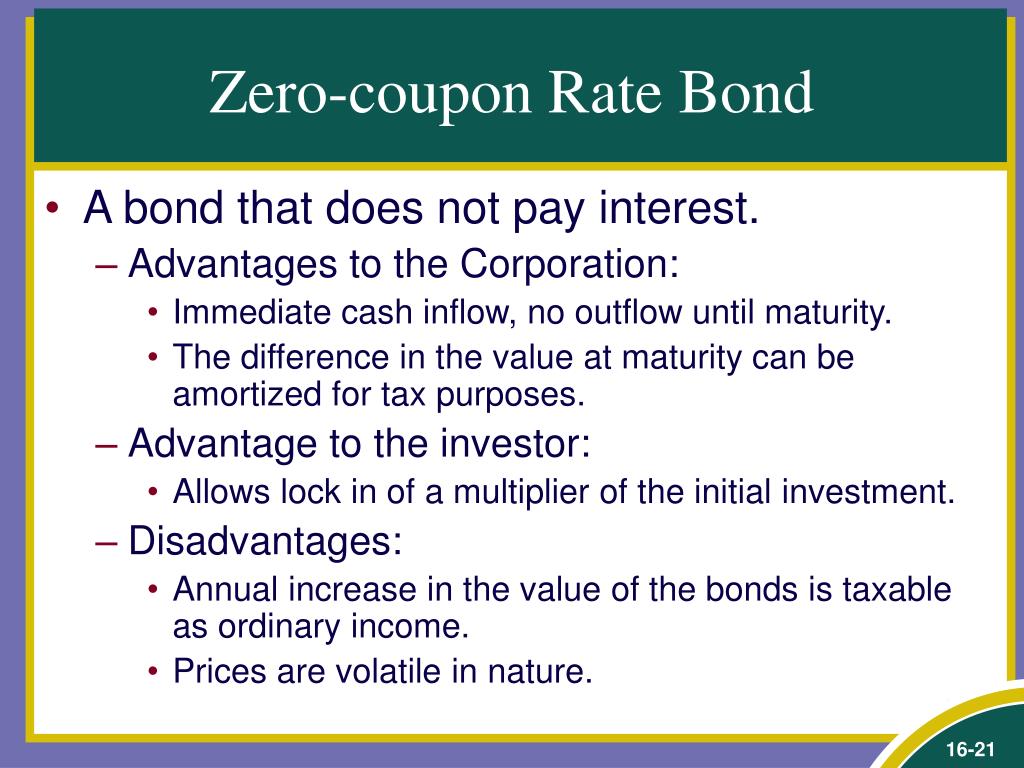

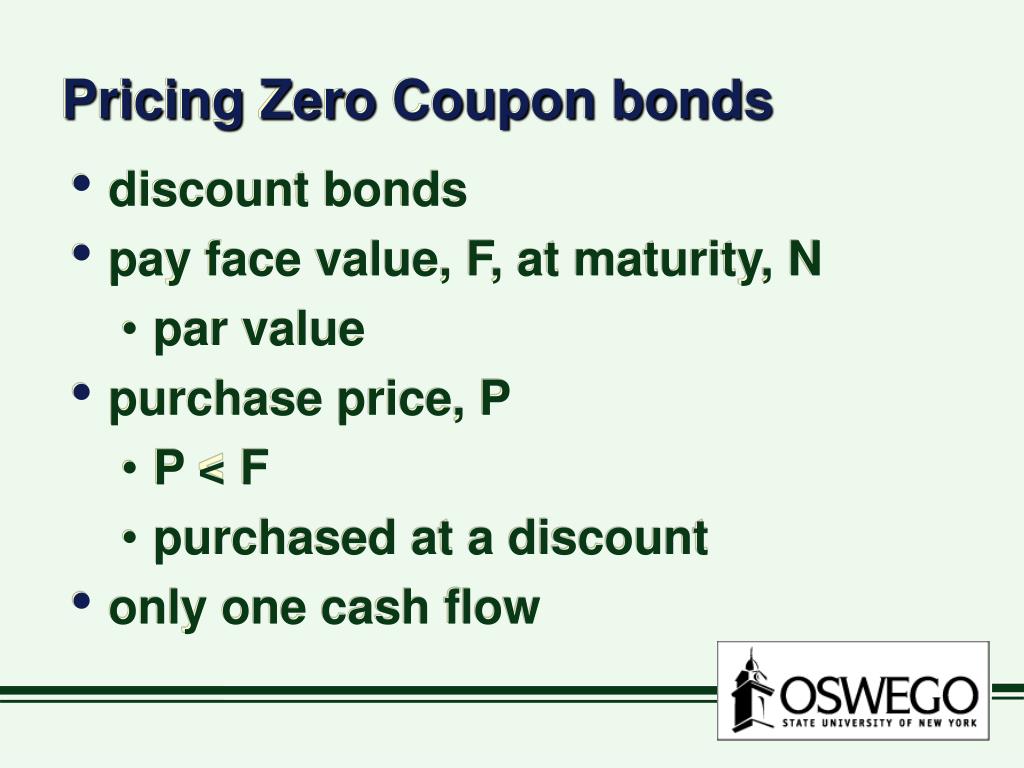

The ABCs of Zero Coupon Bonds | Downing Tax & Financial Service The ABCs of Zero Coupon Bonds. At first blush, the idea of a bond that doesn't pay interest seems oxymoronic. After all, isn't a bond a debt instrument that pays periodic interest and repays the principal at maturity? 1 Zero coupon bonds are indeed debt instruments, but are issued at a discount to their face value, make no interest payments, and pay its face value at time of maturity. Government Bonds India- Invest in Government Bonds Zero Coupon Bonds – As the name suggests, it earns zero interest i.e. no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. Are Bonds Taxable? 2022 Rates, Types of Bonds, Tax-Minimizing Tips With a zero-coupon bond , you buy the bond at a discount from its face value, don't receive interest payments during the bond's term, and are paid the bond's face amount when it matures. For...

Zero coupon bonds tax. Taxation of bonds and debentures - TaxGuru In case of bonds which are listed, the taxpayer has the option to pay tax at 10% of the profits on sale or redemption. However the option to pay tax at concessional rate of 10% in stead of 20% is not available for zero coupon bonds. Tax exemptions available in respect of long term capital gains arising on bonds Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Publication 1212 (01/2022), Guide to Original Issue Discount (OID ... It discusses the income tax rules for figuring and reporting OID on long-term debt instruments. It also includes a similar discussion for stripped bonds and coupons, such as zero coupon bonds available through the Department of the Treasury's STRIPS program and government-sponsored enterprises such as the Resolution Funding Corporation. Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Government-issued bonds are the tax-free instrument, but the corporate bonds Corporate Bonds Corporate Bonds are fixed-income securities issued by companies that promise periodic fixed payments. These fixed payments are broken down into two parts: the coupon and the notional or face value. read more are not tax-free for the investors.

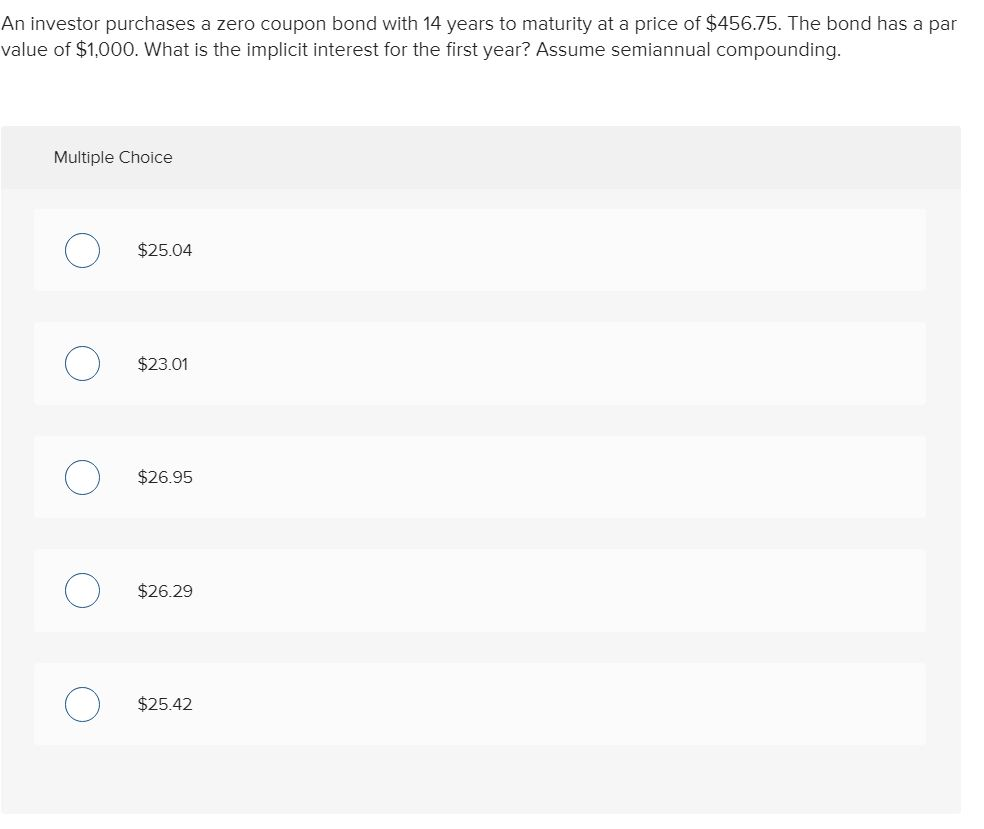

Swiss Re opts for zero-coupon & multi-year notes in new … 07-06-2022 · The Class A tranche are zero coupon discount notes, which at launch were priced at 90% to 90.5% of par and these have a term to December 2022, so only covering the coming hurricane season. Secondary Bonds Market – Types of Bonds India You can Invest in Secondary Bonds in India. Types of Bonds in India including PSU Bonds, Corporate Bonds, Tax Free Bonds, Government Security Bonds, Zero Coupons, Convertible Bonds, Sovereign Gold Bonds, Perpetual Bonds, Green Bonds, Covered Bonds, State Development Loans, Market Linked Debenture Bonds. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Understanding Zero Coupon Bonds - Part One - The Balance You buy zero coupon bonds a deep discount to face value. You receive no interest until maturity; however, in most cases, you do owe taxes annually on the interest as it accrues. In Part Two In part two, we'll look more closely at the tax implications of zero coupon bonds and examine how you can use zeros to meet your financial goals.

The Ultimate Guide to Bonds | Bonds | US News 07-05-2020 · Instead, investors buy zero-coupon bonds at a discount to par and then receive the full face value when the bond matures. You might pay $10,000 for a bond that will return $20,000 in 20 years. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest. Compound Interest Compound interest is ... Zero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bonds- Taxability under Income Tax Act, 1961 According to this proviso, tax on long term capital gain on zero coupon bonds shall be lower of the following: - (a) Tax on capital gains computed normally @ 20% on difference of maturity price and purchase price (indexed) or

Zero-Coupon Bond Definition - Investopedia 11-11-2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

How is tax calculated on a zero coupon bond? - Quora For example, a $1,000 face, zero-coupon five year bond pays $1,000 in five years. A $1,000 face 4% coupon five year bond pays $180 in coupons over the five years, plus $1,020 at maturity (assuming a semi-annual coupon). A zero coupon bond will typically also sell at a higher yield than a similar positive coupon bond, which reduces Continue Reading

Government - Continued Treasury Zero Coupon Spot Rates* 14-08-2013 · IRS Tax Credit Bonds Rates; Treasury's Certified Interest Rates. Federal Credit Similar Maturity Rates. Prompt Payment Act Interest Rate. ... Continued Treasury Zero Coupon Spot Rates* Treasury Spot Rates, Office of Thrift Supervision (OTS) Method; End of Quarter, Percent; Maturity 2012 2013; Years Months I II III IV I II; 0.5: 6: 0 ...

PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) the tax free rate to the after tax rate of return is a common comparison in evaluating taxable and tax free investments. A zero coupon bond pays only at maturity and doesn't pay periodic interest. For a taxable zero coupon bond, the IRS requires that income taxes be paid annually as OID securities

tax free bonds: Latest News on tax free bonds | Top Stories ... May 15, 2022 · The top court, which allowed a batch of appeals filed by banks against an order of the Kerala High Court, held that the proportionate disallowance of interest is not warranted under Section 14A of Income Tax Act for investments made in tax free bonds/securities which yield tax free dividend and interest to assessee Banks in those situations where, interest free own funds available with them ...

Advantages and Risks of Zero Coupon Treasury Bonds 31-01-2022 · Unique Advantages of Zero-Coupon U.S. Treasury Bonds . Treasury zeros zoom up in price when the Federal Reserve cuts rates, which helps them to protect stock holdings at precisely the right time.

Tax Considerations for Zero Coupon Bonds - Financial Web Tax Considerations Zero coupon bonds have unique tax implications. Technically, you are earning interest every year, even though you do not see it until the end of the bond term. Therefore, you have to pay the taxes on the interest every single year even though you do not get the interest until the end of the arrangement.

tax free bonds: Latest News on tax free bonds | Top Stories 19-04-2022 · The top court, which allowed a batch of appeals filed by banks against an order of the Kerala High Court, held that the proportionate disallowance of interest is not warranted under Section 14A of Income Tax Act for investments made in tax free bonds/securities which yield tax free dividend and interest to assessee Banks in those situations where, interest free own funds …

Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond.

How to Invest in Zero-Coupon Bonds | Bonds | US News The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue.

Taxes and zero coupon bonds - FMSbonds.com Tax-exempt interest earned on zero coupon bonds should be reported on your 1040, along with all other tax-exempt interest received. The interest reported is based on the original issue price and yield or, as you stated, "the bond's original accretion." Your adjusted basis in the bonds at any time after purchase would be your actual purchase ...

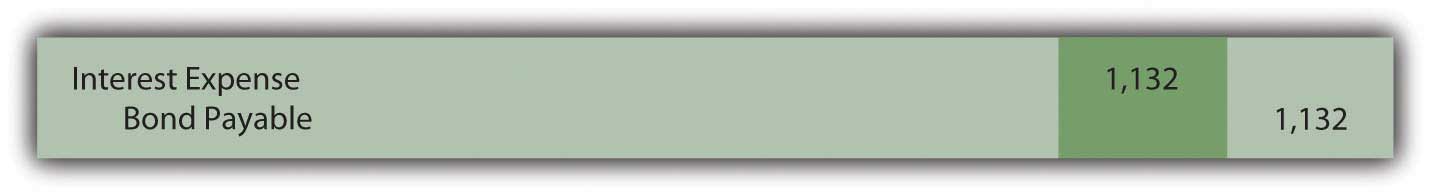

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method

Advantages and Risks of Zero Coupon Treasury Bonds Jan 31, 2022 · Zero-coupon U.S. Treasury bonds have a poor risk-return profile when held alone. Long-dated zero-coupon Treasury bonds are more volatile than the stock market, but they offer the lower long-run ...

How to Buy Zero Coupon Bonds | Finance - Zacks The bonds are issued at a minimum face value of $1,000, and the earliest a Treasury zero bond matures is in 10 years. The bond interest income is taxed at the federal level and possibly at the...

The ABCs of Zero Coupon Bonds - Tax & Wealth Management Zero coupon bonds are subject to an unusual taxation in which the receipt of interest is imputed each year, requiring holders to pay income taxes on what is called "phantom income." Target Dates For individuals, zero coupon bonds may serve several investment purposes.

Impact of Taxation on Zero-Coupon Muni Returns Taxation on zero-coupon munis is only realized upon their sale or maturity. If the bond is sold before its maturity, it is either sold at a discount or a premium in the secondary market. Any price paid above the adjusted issue price (discussed below) will be premium and any price below the adjusted issue price will be discount.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. After 20 years, the issuer of the bond pays you $10,000.

Post a Comment for "38 zero coupon bonds tax"